BE LIFE RICH,

NOT HOUSE POOR!

Buying at the top end of your pre-approval price could

be setting you up for many dull years to follow.

WHY?

Because, your home cost is more than just a mortgage payment.

There are property taxes, maintenance, utilities and more due every month. If those add up to 35% of your total income, you’re on the right track. If not you might have to sacrifice in other categories such as vacation, debt repayment or savings.

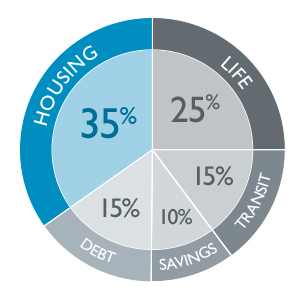

Budgeting is really a piece of cake, or a pie in this circumstance. The pie chart here illustrates a tried, tested and true method to financial success. It shows how your entire set of financial responsibilities can be broken down into these five areas.

Housing - 35%

This section contains any monetary contributions you make to your home. This can include your mortgage, property tax, water, electricity bills, equipment rentals or maintenance. See how it’s much more than your mortgage? Your local mortgage broker can help you get a good idea of what these costs will be.

Transit - 15%

This slice refers to any transportation costs you incur such as: car payments, maintenance, gas, insurance, parking costs or transit passes. You might be surprised how much your trip to work is costing you.

Debt - 15%

No debt? No problem! Spread your 15% throughout your other four sections. But if you are like most people you have accumulated some sort of non-mortgage debt. Your auto and home debts are not included in this section as they are fixed expenses. This slice of the pie includes debt incurred on credit cards, lines of credit and student loans.

Savings - 10%

What would you do if you lost your job tomorrow? No sure? This is why 10% of your income should be going to your savings. In today’s economy, it’s important to keep yourself protected should the worst happen.

Life - 25%

The final slice of the pie is all about you. Your food, entertainment, medical expenses, technology, vacations and really anything that doesn’t fall into the other four categories falls here.

All it takes to balance your budget is a bit of time and organization. The more you apply it the better your financial position becomes and the more home you can buy, knowing full well you can still be life rich living in it.

Help is available, contact us today to see how your next home fits into your budget.

Considering a fixed rate mortgage? Get informed!

Considering a fixed rate mortgage? Get informed! Renovating your home is within financial reach. Find out how!

Renovating your home is within financial reach. Find out how! Is your mortgage coming up for renewal? You should talk to a broker!

Is your mortgage coming up for renewal? You should talk to a broker!

Want a mortgage? Get a mortgage! Apply now!

Want a mortgage? Get a mortgage! Apply now!

Want to find your monthly payment or what you can afford? Find out this and more with our easy to use calculators!

Want to find your monthly payment or what you can afford? Find out this and more with our easy to use calculators!